Warhol: missing from this year’s sales but is he Trump’s muse? Photograph: Christopher Thomond for the Guardian

At the same time, many of the younger artists whose work had been driven up in value over the past several years, saw their work unceremoniously dumped at auction, reflecting the speculative spirit in which it had been purchased.

Collector Niels Kantor told Bloomberg News he paid $100,000 for an abstract canvas by Hugh Scott-Douglas. Two years later, in September, he sold it at Phillips for $30,000. “I’d rather take a loss,” Kantor told the market data service. “It’s like a stock that crashed.”

Phillips estimated that half of the 204 lots in the same sale were below $10,000 – an indicator that speculators were dumping work. Instead of new artists, art advisers indicate many collectors are now most interested in rediscovering historically important artists that have slipped past undervalued.

Two high-profile forgeries made headlines in 2016, forcing the business to take steps to reassure customers.

Jurors in the Knoedler Gallery fraud trial in New York, heard how more than a dozen abstract expressionist masters were forgeries, while forensic conservator James Martin concluded that an $8.4m Frans Hals painting sold to a US collector by Sotheby’s was fake. The auction house quickly moved to hire Martin to provide museum-quality expertise.

But the big unanswered, and perhaps unanswerable, question, is how the new political environment could affect the market.

The softness in the art market in 2016 could be seen in the low attendance at Art Basel in Miami Beach this year and mirrored in sales across most luxury market sectors, including real estate.

Yet the November auction sales proved unexpectedly robust following Donald Trump’s election.

Sotheby’s CEO, Tad Smith, told CNBC that the result had helped boost optimism in the art market. “I think there’s been a fairly good feeling among the art collectors this week,” Smith said in November. “There’s just a lot of very wealthy people from all types of countries … and they have a lot of capital to deploy.”

Market observers have not been slow to note the similarities between Trump’s approach to business and that of Andy Warhol, who set up his studio production and promotional publishing machine in ways that correspond to Trump’s real estate and self-promotion machinery.

Artnet noted explicit similarities between Trump’s business philosophy outlined in The Art of the Deal and Warhol’s The Philosophy of Andy Warhol: “Making money is art, and working is art and good business is the best art,” Warhol said succinctly.

Trump meanwhile offered this: “I don’t do it for the money. I’ve got enough, much more than I’ll even need. Deals are my art form. Other people paint beautifully on canvas or write wonderful poetry. I like making deals, preferably big deals. That’s how I get my kicks.”

Many members of the incoming administration’s cabinet, including the treasury secretary, Steven Mnuchin, and commerce secretary, Wilbur Ross, are art collectors. The art market boomed during the Reagan administration and through most of George W Bush’s tenure.

Still, Maneker says it’s too soon to speculate on the art market under Trump.

“You can draw two diametrically opposed scenarios based on the same behavior. If Trump raises tariffs and causes global panic, art could then become exceedingly valuable because it’s portable, easy to store and not a currency. But it could also become worthless. Nobody knows the right answer.”

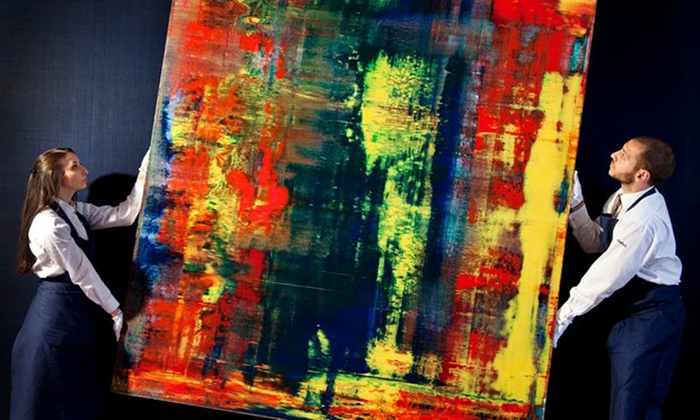

But as the year in art turns, at least there has been some good news for rock’s elite in what has been in all other terms a dark year. In the weeks after September 11 2001, guitarist Eric Clapton acquired, in a single lot at Sotheby’s, three Gerhard Richter abstracts for $3.4m. He sold the last of the three, Abstraktes Bild (809-2), at Christie’s in November for $22.1m, bringing his total profit on all three works to $74.1m.

There was another winner, too, from the rock world. Christie’s outgoing head Gorvy revealed last week, he had sold a Jean-Michel Basquiat boxer painting from Christie’s private selling exhibition via his Instagram feed. The buyer was an unnamed American collector who paid $24m sight unseen. The seller? Metallica drummer Lars Ulrich.