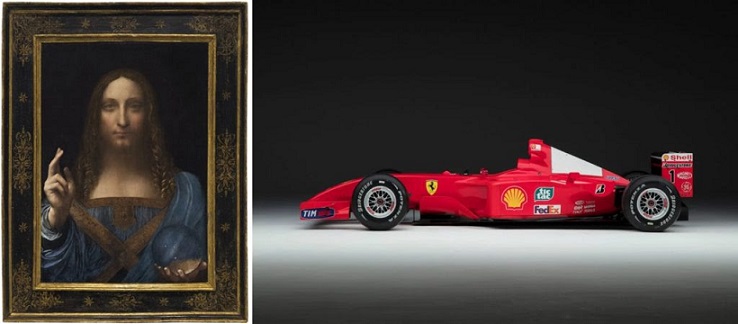

Leonardo da Vinci’s Salvator Mundi and the 2001 Ferrari sold at Sotheby’s.

Biggest Trend: Cross-Genre Sales

We all know postwar and contemporary is the most profitable category in the auction business—and this season, specialists proved just how far they would go to get in on the action. Christie’s notoriously included Leonardo da Vinci‘s 500-year-old Salvator Mundi in its evening postwar and contemporary sale, while Sotheby’s threw in a 2001 Ferrari (yes, an actual car) alongside Bacon and Warhol. (Sotheby’s, perhaps admirably, did not even try to offer an art-historical justification for the move. Grégoire Billault, the head of the sale, told the FT: “To call it a work of art is maybe pushing it and it isn’t to everyone’s liking, but it is contemporary and beautiful and chimes with our generation.”)

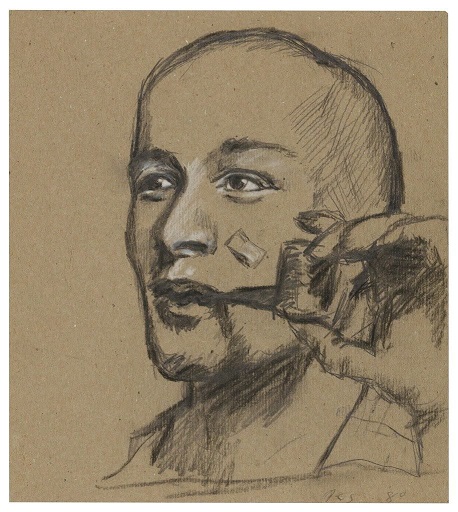

Phillips also pushed the boundaries of its contemporary evening sale—though to a much less radical extent—by including a Picasso work on paper, Portrait de femme endormie III (1946). Buyers didn’t seem to mind: It sold for $9.3 million, nearly nine times its high estimate.

Marc Chagall’s Les Amoureux (1928). Image courtesy Sotheby’s. © 2017 Artists Rights Society (ARS), New York / ADAGP, Paris

Most Improved: Impressionism

The Impressionist and Modern market—“which has been considered dying or dead,” in the words of Allan Schwartzman, the co-founder of Art Agency Partners—“was extraordinarily alive and healthy.” The challenge for the sector is not the market or taste, Schwartzman says, but “access to great material.” Both houses lodged their best totals for the category in recent seasons. Sotheby’s pulled in $311 million, compared with $213 million this past spring and $196 million in fall 2016. Meanwhile, Christie’s touted its $531 million total as the best in a decade, and it easily eclipsed the $318.6 million total this past spring and $279 million last fall.

Alex Rotter and Loic Gouzer conferring at the height of the phone-bidding during the evening sale at Christie’s. Eduardo Munoz Alvarez/Getty Images.

Biggest Increment: $30 Million

Even in eight-figure nosebleed territory, bids at auction tend to climb in increments of $500,000 or $1 million on average. (Hey, you don’t get rich by spending money willy-nilly.) Jaws were already starting to drop during the 19-minute contest for Leonardo da Vinci’s Salvator Mundi when the bidding started jumping in $10 million increments. Then, Alex Rotter stunned the room when he jumped from $370 million to $400 million on behalf of his client, knocking out the competition and securing the work for the highest price in auction history with arguably the largest increment ever lodged in a public auction.