Every year (and occasionally more frequently), a constellation of leading lights from across the art industry convenes for Talking Galleries, a symposium meant to address the unique challenges and possibilities facing the gallery sector. Occasionally, they also let in riffraff like yours truly. And after two days of presentations, panel discussions, and networking in Barcelona—a city where I learned you can eat the best sandwich in the worlddirectly across the street from a Subway franchise—here’s my recap of the five major themes that emerged from this year’s colloquium.

Talking Galleries Barcelona Symposium 2018. © Xavi Torrent. Courtesy Talking Galleries.

1. The Scale and Pace of the Gallery Sector Have Become Cancerous for Many.

By “cancerous,” I don’t just mean generically dangerous, or even life-threatening. I specifically mean that the diagnosis applies because the number of transactions, the prices involved, and the speed at which they take place have all accelerated to an unsustainable level, the way unchecked abnormal cell reproduction produces malignant tumors.

The alarm bell on this subject rang immediately, as opening keynote speaker Daniel Templon walked us back through his more than 50 years at the helm of present-day powerhouse Galerie Templon. (Note: Since I am a dumb monolingual American, I could only record the simultaneous English translation of Templon’s French, so don’t hold the man himself to any exact wording that follows in quotation marks.)

When asked about his first consistent collectors, Templon admitted that he could not name them because they were all “nobodys”—doctors, lawyers, and dentists who were otherwise run-of-the-mill, even within their own respective fields. Their equivalents today would be hopelessly outgunned by millionaires and billionaires.

And while Templon noted that the 1990 economic crash reduced him to selling only about 14 works per year until the market recovered, his average sales in the rosy period before the crash only comprised about 40 pieces annually. That’s about one good month for a mega-gallery sales associate in 2018.

In fact, Templon went on to argue that buyers now have so much money that the art market—a term that he and his colleagues “did not talk about” when the gallery was founded in 1966 —“absorbs everything,” including works by mediocre artists.

But collectors are hardly the sole source of the problem, according to other speakers. Art advisor Lisa Schiff declared in a later panel that she considers it a key part of her role “to protect [her] collectors” from the voracious sales teams deployed by big galleries, which, she said, are more intent on exceeding a monthly quota than thoughtfully placing compelling works in the right context.

Longtime gallerist Ursula Krinzinger placed part of the blame on young gallerists themselves—or more precisely, on their unrealistic expectations for success. Based on her experience, she said that no gallerist should plan on turning a profit before celebrating a full decade in business. Yet, in her estimation, many of her younger colleagues now “want to be millionaires within three years” of opening their doors. This pinched time horizon leads to a level of sharking, money-first aggression that only distorts the market further.

The Takeaway: There are too many buyers generating too much income and creating too much demand, with too many gallerists—and, I will add, too many artists—becoming all too willing to satisfy it by any means necessary.

Keynote speaker Daniel Templon with Georgina Adam at Talking Galleries Barcelona Symposium 2018. © Xavi Torrent. Courtesy Talking Galleries.

2. Different Tiers of Galleries Are Now Playing Different Games With Different Rules.

Although this subject loomed largest in the panel titled “What Future for the Art Market at the Mid-Level?” it cast a shadow of some size over session after session during the two-day symposium. In the midst of the aforementioned discussion, Jean-Claude Freymond-Guth, whose namesake midlevel gallery shuttered last year, implored his colleagues to stop modeling their own smaller businesses after mega-gallery conquistadors. Instead, he recommended they “redefine [their] own program and work within it.”

In other words, don’t listen to Kanye, who once rapped that you should “shoot for the stars/cause if you fall/you’ll land on a cloud.” Multiple experts suggested—usually based on past experience—that if the average gallerist tries to mimic the sector’s leaders by proliferating a fleet of permanent spaces, exhibiting at every art fair, and generally behaving as if too much is never enough, disaster likely awaits. Far better to take a young Michael Jackson’s advice and start with the man (or woman) in the mirror. At least, as long as that assessment involves brutal honesty about one’s goals, strengths, and limitations.

The same idea arose in a next-generation context during the panel I moderated on “Changes in the Online Art Market.” There, both Sophie Neuendorf, the director of artnet’s Gallery Network, and Saskia Clifford-Mobley, head of Artsy’s gallery partnerships in Europe, the Middle East, and Africa, agreed that there is no shortcut solution for a gallery’s online strategy. Success instead comes from carving out one’s unique identity and goals, then working with others to tailor a digital presence that reflects both.

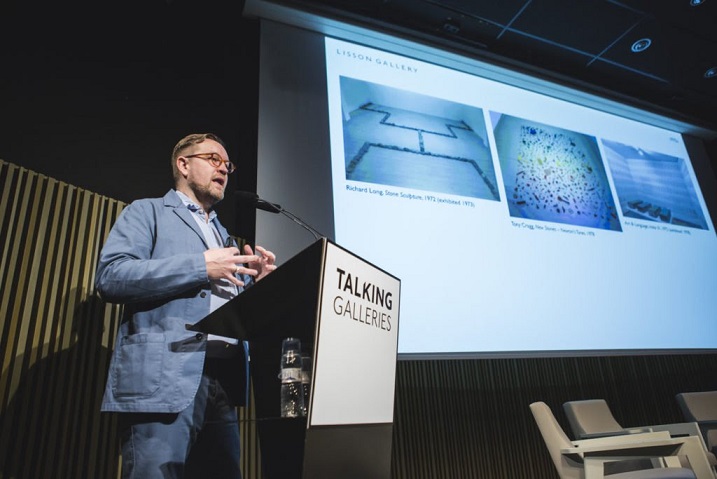

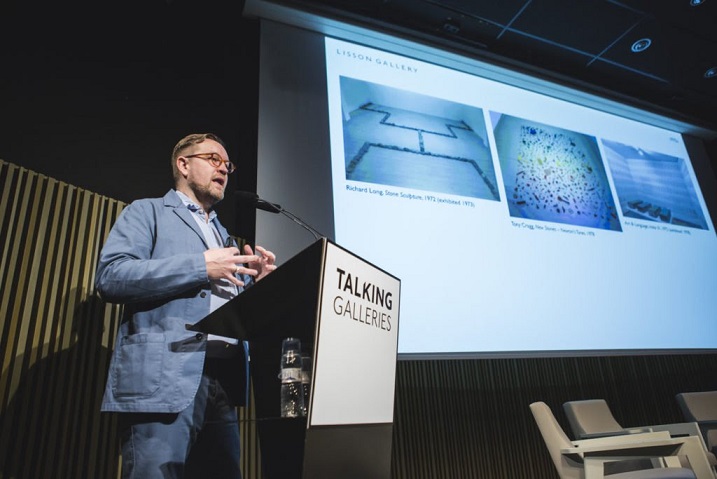

This advice—don’t try to emulate another business, but rather figure out what makes yours unique—has served as a productive guiding light even before the digital revolution. In a solo presentation on capturing Lisson Gallery’s first 50 years in the colossal offsite exhibition “Everything at Once,” Ossian Ward, the gallery’s head of content, described how Lisson grew less as a business than as a kind of social amalgam of like-minded, similarly aged, compatibly engaged personalities.

The Takeaway: Since following the commercial gods of the gallery sector won’t necessarily lead to Valhalla, cultivating a community matters just as much as mounting shows and selling works… and doing the former may be the single best strategy for doing the latter.

Ossian Ward of Lisson Gallery presenting during the symposium’s first day. © Xavi Torrent. Courtesy Talking Galleries.

3. The Art Industry Must Break Out of Its Silos and Create “an Ecosystem of Exchange.”

The quote in that line came courtesy of gallerist and Independent art fair founder/CEO Elizabeth Dee, who voiced it in the midst of a panel titled “Ways of Collaborating Among Galleries.” But her message wasn’t just that modestly sized galleries need to discard the competitiveness alienating them from one another. They also need to do the same when it comes to their relationships with art fairs, advisors, and other participants too often and too conveniently cast as their antagonists. In short, she and her co-panelists proposed that those below the commercial apex—no matter their precise roles—would be best served by thinking about how to innovate unprecedented, sustainable forms of partnership among themselves, not about how they might be able to reach the tip-top by climbing over one another.

Nor should members of the industry be satisfied with breaking down the barriers segmenting the sales side. Alain Servais—the collector, finance pro, and only dude I’ve ever seen make an ascot look like a good idea—posited that it has become equally important for gallerists to consider collaborating with collectors, financial backers, or other sponsors to remain viable amid the fixed-cost gauntlet of the 2018 gallery business.

Servais and Freymond-Guth even carried this idea to its logical endpoint. They discussed how smaller, more experimental galleries are often the ones that take the risks and make the sacrifices that bring cultural legitimacy to the larger, more luxurious elements of the industry, which largely traffic in artists whose reputations are already faits accomplis. As an example, Servais suggested that “the Focus sections of fairs”—a shorthand for themed sections featuring younger galleries, often organized by a high-profile curator—are in fact a critical tool for art fairs to preserve a degree of curatorial credibility rather than just looking “like a shopping mall full of big brands.”

The question hanging in the air at the end of this exchange was simple and crucial: If risk-taking smaller galleries are, in effect, culturally subsidizing larger, safer entities, don’t those larger, safer entities have a responsibility to financially subsidize the smaller galleries for the value they add to the enterprise?

The point is that the real relationship between galleries at different price tiers is not competitive—it’s symbiotic. Without smaller galleries developing lesser-known artists and novice collectors, the top tier of the market will lose the feeder system on which it depends for long-term growth.

In this view, the gallery sector’s have-nots will suffer first in an adverse art economy. But if the lions of the market think they’re immune to danger, it’s worth remembering that every species is a goner if the bees die out.

The Takeaway: Without both horizontal and vertical collaboration among participants in the primary market, the entire structure could transform into a pure luxury retail space.

Alex Logsdail of Lisson Gallery, David Juda of Annely Juda Fine Art, and Jorge Romero Parra of Parra Romero with moderator Carlos Urroz. © Xavi Torrent. Courtesy Talking Galleries

4. Lack of Transparency Is Undermining Everyone, But Especially the More Modest Tiers of the Business.

I’ve written before about opacity’s importance to the high end of the art trade, and my Talking Galleries presentation on the online market sprang from how, to borrow the words of screenwriting legend William Goldman, nobody knows anything about how sales in the space have really been performing. We do, however, have at least some evidence from Artsy (via its 2017 Gallery Survey Roundup) that gallerists/dealers who list pricing and availability information online increase their odds of receiving quality inquiries, making sales, and even closing those sales at higher prices.

But if the Artsy survey data represented the light half of the moon, other speakers communicated just how deadly the dark side has become to other aspects of the industry. The art-market analyst Clare McAndrew noted that most, if not all, traditional banks won’t even consider loan applications from galleries, in part because of the permanent fog hovering over the business as a whole.

Opacity was also one of the (many) flashpoints in a fiery panel discussion on the prospect of cooperation between gallerists and art advisors. Multiple members of the former tribe criticized those in the latter for everything from the absence of codified best practices—ironically, an absence just as obvious in the gallery sector—to their refusal to wear some kind of hypothetical identification badges at art fairs (as we Scarlet-Lettered zealots in the press do).

Servais, an investment banker by trade, even delivered the sobering judgment that the art market has worse ethics than the finance industry. Which, let’s be real, is about as damning as being told by a Depression-era scholar that you have worse hygiene than a boxcar tramp. And while a lack of transparency doesn’t necessarily guarantee bad behavior, it certainly incentivizes it. For many, those incentives are off-putting enough to keep them out of the market entirely.

The Takeaway: Openness isn’t a nicety. Limited data and ample experience say it’s a business strategy that can reap rewards for individual mid-level galleries and the sector more broadly.

Christy MacLear, Adam Sheffer, and Hélène Vandenberghe discussing management of artists’ estates. © Xavi Torrent. Courtesy Talking Galleries.

5. Attracting New Audiences Will Be Crucial—But Doing So Will Require Uncomfortable Changes.

Early in his remarks during the aforementioned mid-level gallery panel, TEFAF Chairman Nanne Dekking stated that “the art market is the only one where we’re not actively reaching out to the customers we don’t yet have.” His proclamation received a strange proof of concept a day later.

In defense of Lisa Schiff, who some in the auditorium seemed set on turning into a sacrificial proxy for the worst-behaved members of her discipline, Servais noted that collector friends had told him that they hired art advisors solely because they needed to “market themselves to gallerists” as worthy buyers. (The subtext, of course, is that the fact that they were deep-pocketed and eager wasn’t enough to get them access on their own.)

But new blood is not merely important to the most commercial side of the market. Christy MacLear, Vice Chairman of Art Agency, Partners and former head of the Robert Rauschenberg Foundation, stressed during a panel on managing artists’ estates that university museums can play an important role in building an artist’s legacy.

Since students, particularly graduate students, tend to focus on the resources available to them, donating artwork or archives to their institutions can increase the likelihood of connecting one artist to the next great generation of scholars. And those scholars can expand our understanding of said artist’s practice for dozens of years as their own careers grow.

The question is whether the gallerists in the most peril are ready to commit to changing. As Art Dealers Association of America president and Cheim & Read partner Adam Sheffer observed, almost no attendees over the age of 50 seemed to stick around for the tech-centric panels that closed the symposium.

The flip side, however, is that the auditorium was still full, or nearly so, with younger gallerists, professionals, students, and entrepreneurs eager to engage.

The Takeaway: If most longtime gallerists continue clinging to familiar patrons and familiar methods, then the art business, as physicist Max Planck once said of science, will only “advance one funeral at a time.” But either way the next generation appears ready to step up and reach out.