Sheldon Solow enjoys big tax breaks on his art collection, but taxpayers never get to see it

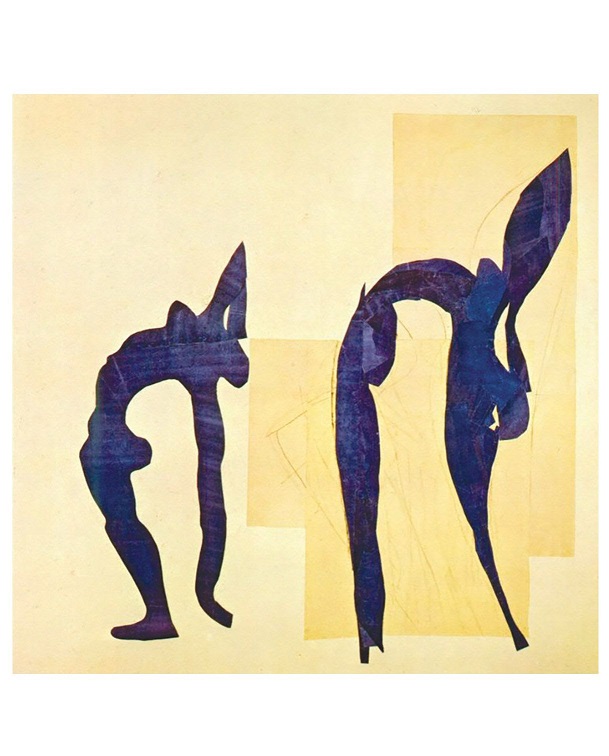

Matisse's Acrobats is one of several famous works not on display. Photo: Getty Images

Octogenarian Sheldon Solow recently discussed plans to pass on the family real estate business to his son, Stefan Soloviev. The empire of the Forbes-ranked billionaire includes his namesake office tower, a collection of rental buildings and one of Manhattan's largest remaining development sites, in Midtown East. But Solow also appears poised to hand off a much less visible family jewel: a nonprofit art museum that receives federal tax breaks despite never being open.

The Solow Art and Architecture Foundation is located on the ground floor of the Solow Building at 9 W. 57th St. and has been registered as a nonprofit with the Internal Revenue Service since 1991. As of 2015, the small museum boasted an enviable collection of artwork by household names including Jean-Michel Basquiat, Sandro Botticelli, Henri Matisse, Joan Miró and Vincent van Gogh. Its mission, according to the most recent public disclosure that included one, is to maintain and display artwork for exhibition to the public. Yet by all accounts, the public is not welcome.

Nonprofit museums are a popular way for the wealthy to house their art collections. A foundation's benefactor can purchase works, donate them to the foundation and then take a federal tax deduction for a portion of the value. It's unclear how much Solow has been able to shave off his bill to Uncle Sam by donating artwork to his foundation, but his nonprofit's collection was valued at more than $200 million in 2015, up from $96 million in 2003, public records show.

Out of service

The IRS is willing to forgo the tax revenue as long as the nonprofit provides a public service in exchange—namely, showing art to the people. But private museum owners lately have come under scrutiny for operating more like private collections while still taking generous tax breaks.

In 2016, for example, the U.S. Senate Committee on Finance conducted an inquiry into 11 private art museums and found that many of them had problematic operating procedures. The foundations had few independent board members or executives, were located on the founder's property and were apt to keep odd hours, require advance appointments or close for months at a time, making it difficult for the general public to view the art.

"Despite the good work that is being done by many private museums," Sen. Orrin Hatch said in a statement at the conclusion of the review, "I remain concerned that this area of our tax code is ripe for exploitation."

Solow's art collection has been valued at more than $200 million. Photo: Getty Images

Solow's charity issues grants to arts organizations most years. Nevertheless it appears to embody many of the worst qualities identified in the Senate's inquiry. He was listed as the sole executive and board member in the nonprofit's latest filing. The museum is located inside the office building where his company is headquartered. And the organization does not appear to allow the public to visit at all. A woman who answered the phone this month said the collection is open to scholars who present a specific research request. Everyone else, she said, can view the works from the street outside.

The museum's nonexistent hours have prompted sporadic articles in the past decade. Recently they inspired Ethan Arnheim, an international development adviser based in Washington, D.C., to create a parody website that includes biographies, a description of the foundation, frequently asked questions and hours of operation: "Monday, inaccessible. Tuesday, closed. Wednesday, no public hours. Thursday, not open. Friday, same as the rest of the week. Saturday, none. Sunday, absolutely not."

"I created this site out of frustration," Arnheim said. "If you want to keep an art collection private, that's fine—you should be able to do anything you want. But we as taxpayers are paying for this."

Solow did not respond to a request for comment. A spokeswoman for the state attorney general's office said it regulates donations but not nonprofit status. The IRS, which is ultimately responsible for exempting organizations from taxation, said it could not comment on a specific nonprofit.

Family portrait

Beginning in 2012, Soloviev's name began appearing in public disclosure documents as an executive of the foundation (though he was not listed in the most recent filing, covering 2016). That suggests, in addition to taking a larger role in the family's real estate business, he might also exert greater control over the charity's artwork. But it would trigger huge estate taxes if the collection were privately owned.

Artwork typically is subject to the federal estate tax, which tops out at 40%, in addition to levies on the state level. Judging from the 2015 value of the charity's collection, that would mean Solow might need to pay about $80 million to bequeath the works to an heir. But if ownership were by the nonprofit, Soloviev could simply assume leadership of the organization without losing a dime of his inheritance.

"If you are going to take a tax write-off, then make it publicly accessible," Arnheim said, "especially if you have such great works."